SEACOAST BANKING CORP OF FLORIDA (SBCF)·Q4 2025 Earnings Summary

Seacoast Banking Beats on VBI Acquisition Strength, Guides to 35% EPS Growth in 2026

January 29, 2026 · by Fintool AI Agent

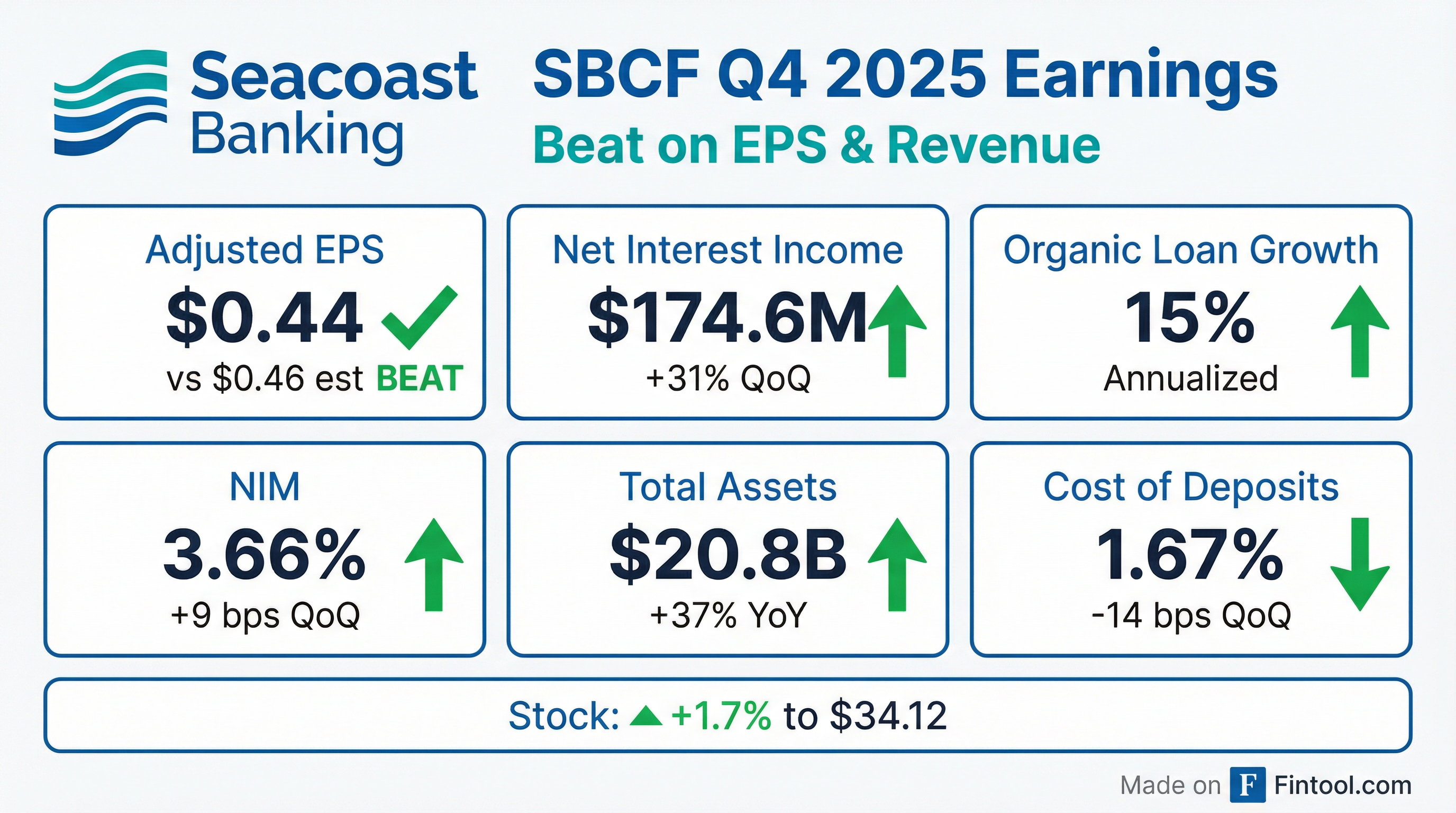

Seacoast Banking Corporation of Florida (NASDAQ: SBCF) reported Q4 2025 results that exceeded expectations, with the transformative Villages Bancorporation acquisition driving significant balance sheet expansion. Net interest income surged 31% quarter-over-quarter to $174.6 million, while the company provided bullish 2026 guidance implying 35% adjusted EPS growth.

Updated January 30, 2026 with earnings call Q&A highlights and management commentary.

Did Seacoast Beat Earnings?

Yes — on both EPS and revenue.

*Values retrieved from S&P Global. GAAP EPS was $0.31 due to $18.1M in merger costs and $23.4M day-one VBI credit provisions.

Beat/miss history (last 8 quarters): Seacoast has beaten EPS estimates in all 8 quarters, demonstrating consistent execution through the rate cycle.

*Values retrieved from S&P Global

How Did the Stock React?

SBCF shares rose +1.7% to $34.12 on the earnings release, continuing a strong run that has seen the stock gain 60% from its 52-week low of $21.36.

The stock is trading near its 52-week high of $35.46, reflecting investor optimism around the VBI integration and 2026 earnings trajectory.

What Changed From Last Quarter?

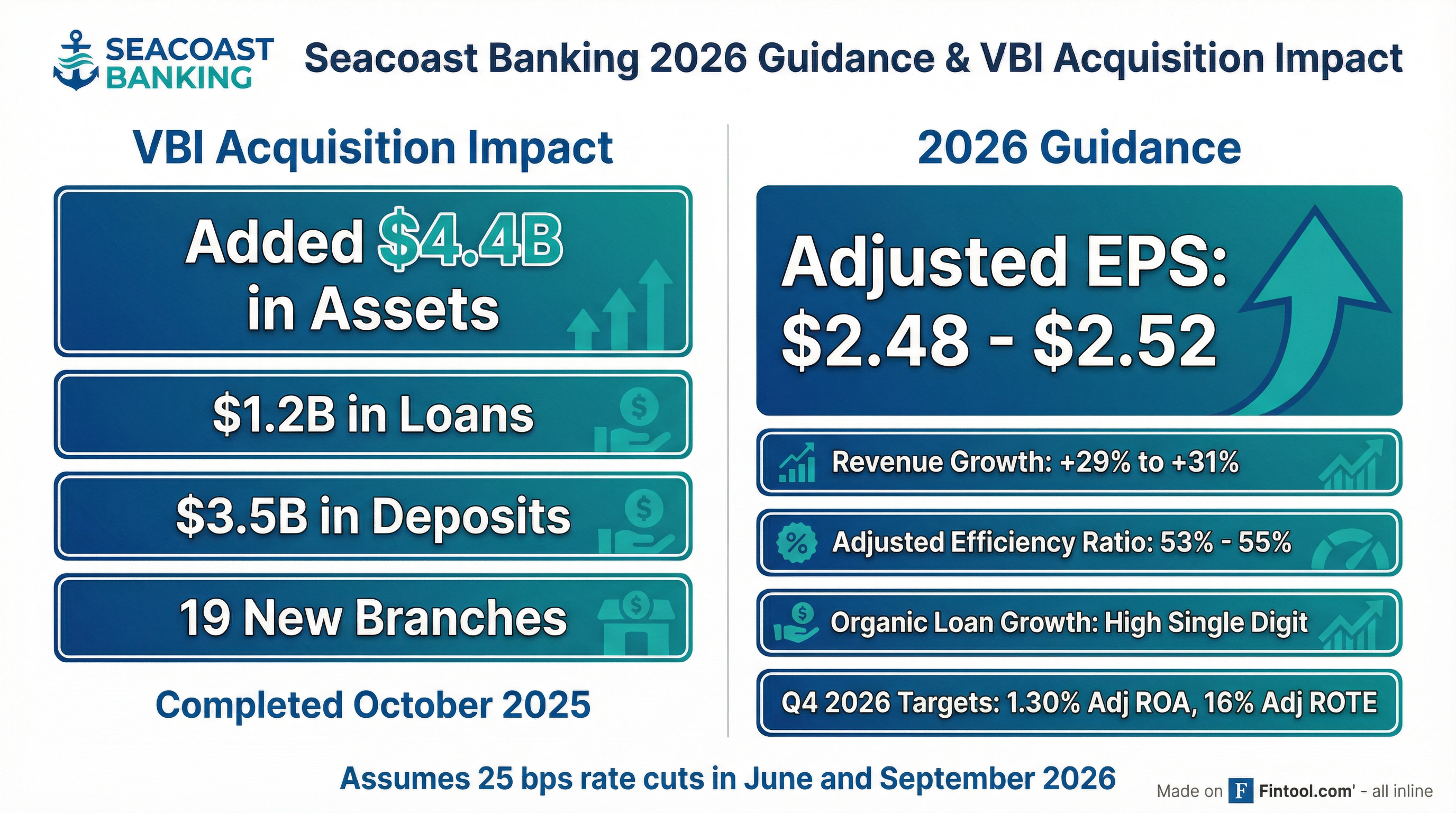

The VBI acquisition closed October 1, 2025, transforming Seacoast's balance sheet:

VBI added: $4.4 billion in assets, $1.2 billion in loans, $3.5 billion in deposits, and 19 branches in The Villages® community and North Central Florida.

Wealth management momentum: AUM increased 37% year-over-year with a 23% annual CAGR over the past 5 years. The team added $550 million in new AUM during 2025.

What's Driving Net Interest Income Growth?

Net interest income of $174.6 million increased 31% from Q3 2025, driven by:

- VBI acquisition impact — Added $2.5B in securities, $1.2B in loans

- Organic loan growth — 15% annualized excluding VBI

- Deposit cost reduction — Cost of deposits fell 14 bps to 1.67%

- Securities yield improvement — Portfolio yield up 21 bps to 4.13%

Securities repositioning in January 2026: Management sold $277 million in low-yielding securities (1.9% book yield) and reinvested in agency MBS at 4.8% yield, taking a $39.5 million pre-tax loss in Q1 2026 but immediately improving earnings power.

What Did Management Guide?

2026 Outlook is bullish:

Q4 2026 targets: 1.30% Adjusted ROA and 16.0% Adjusted ROTE, up from 0.89% and 12.0% in Q4 2025.

VBI capital outperformance: The acquisition closed with 90 bps more total risk-based capital ($92 million) than originally projected at deal announcement (14.7%), driven by lower securities marks and credit marks. This accelerated the tangible book value earn-back period.

Assumptions: 25 bps Fed rate cuts in June and September 2026, stable economic environment, includes benefit of January 2026 securities repositioning.

What About Credit Quality?

Asset quality remains solid despite acquisition noise:

Q4 provision: $29.3 million, primarily driven by the $22.7 million day-one VBI loan loss provision for non-PCD loans.

Net charge-offs were just $0.9 million (3 bps annualized), down from $3.2 million in Q3 2025. Full-year 2025 NCOs were 12 bps vs. 27 bps in 2024.

Key Management Quotes

CEO Charles M. Shaffer on Q4 results:

"The Seacoast team delivered another exceptional quarter, highlighted by the closing of the Villages acquisition and strong growth in loans. Loan outstandings grew at an annualized rate of 15%, driven by the continued success of our commercial banking team."

On The Villages mortgage portfolio:

"The residential loans we added this quarter were very high-quality credits with high FICOs, strong yields, and generally shorter expected lives than traditional mortgage products, given the unique characteristics of this borrower base."

On 2026 outlook and 100th anniversary:

"We closed out a truly transformational year, one marked by industry-leading loan growth, two exceptional acquisitions, and meaningful investments across our company that position us for long-term strength... it's especially gratifying to enter our hundredth anniversary in 2026 with such a strong foundation."

On long-term efficiency ratio target:

"A long-term sort of view on efficiency ratio, one way to think about things is probably low to mid-50s type efficiency ratio target is where we want to operate the company over the cycle."

Capital Position

Seacoast maintains a fortress balance sheet:

*Estimated

Liquidity: $388.5 million cash plus $7.6 billion available borrowing capacity (including $3.4B collateralized credit lines, $3.8B unpledged securities, $348M unsecured lines).

What Did Analysts Ask About?

Q1 2026 Margin Outlook: CFO Tracey Dexter and CSO Michael Young guided to 10-15 basis points of margin expansion in Q1 2026, with securities yield expected to reach 4.40-4.50%. Average earning assets will decline ~$200 million due to seasonal public funds runoff and repositioning-related cash deployment.

Loan Growth Drivers: CEO Shaffer broke down Q4's 15% annualized loan growth: ~10% from legacy Seacoast commercial banking hires, 2-3% from The Villages mortgage portfolio, and 1-2% from slower paydowns. The company is guiding to high single-digit growth in 2026 with optionality from The Villages portfolio.

Banker Hiring Strategy: Management plans to increase banker count by ~15% (approximately 15 bankers) in 2026. Most benefit will be realized in 2027-2028 given ramp time. This hiring push is enabled by stronger profitability and industry merger disruption creating talent availability.

Atlanta Market Expansion: The Georgia market now has ~10 bankers. Shaffer expects to build to a 5-branch footprint with 15-20 bankers plus Treasury support over the next 3 years.

Florida Real Estate Conditions: Shaffer provided nuanced market color:

- Condos: Weak due to retrofit requirements for new standards; uncertainty until retrofits complete

- Southeast Florida (Palm Beach to Miami-Dade): "Exceptionally strong" — prices haven't come down much, demand remains robust

- West Coast (Fort Myers/Cape Coral): Prices declining due to post-COVID overdevelopment

Capital Return: Management acknowledged growing capital levels will create optionality for dividends and buybacks, but near-term focus is on executing The Villages conversion (July 2026).

Efficiency Ratio Change: The adjusted efficiency ratio now includes intangible asset amortization (~$10.4M in Q4), a change from prior presentation. This added approximately 400 bps to the reported ratio.

What to Watch Going Forward

- VBI integration — Technology conversion now targeted for July 2026; execution risk remains

- Rate sensitivity — 2026 guidance assumes two 25 bps cuts; more cuts could pressure NIM

- Banker ramp-up — 15% headcount increase planned; benefits won't materialize until 2027-2028

- Florida real estate pockets — West Coast (Fort Myers/Cape Coral) showing price declines; condo market weak

- Securities repositioning impact — $39.5M loss hits Q1 2026 but drives immediate NIM expansion

- Payoff dynamics — Management expects higher payoffs in 2026 vs 2025; construction loan maturities from 2023 pullback will create headwinds in 2027-2029

Earnings Call Resources

This analysis was generated by Fintool AI Agent based on Seacoast Banking's Q4 2025 8-K filing, earnings presentation, and earnings call transcript.